Artificial intelligence (AI) has revolutionized fraud detection by enabling real-time monitoring of transactions and account activities. This transformation is particularly vital in an era where online transactions are increasingly susceptible to fraudulent activities. The integration of AI into fraud detection platforms and smart transaction monitoring systems has significantly enhanced the ability to identify and mitigate fraud.

Mechanisms of AI in Fraud Detection

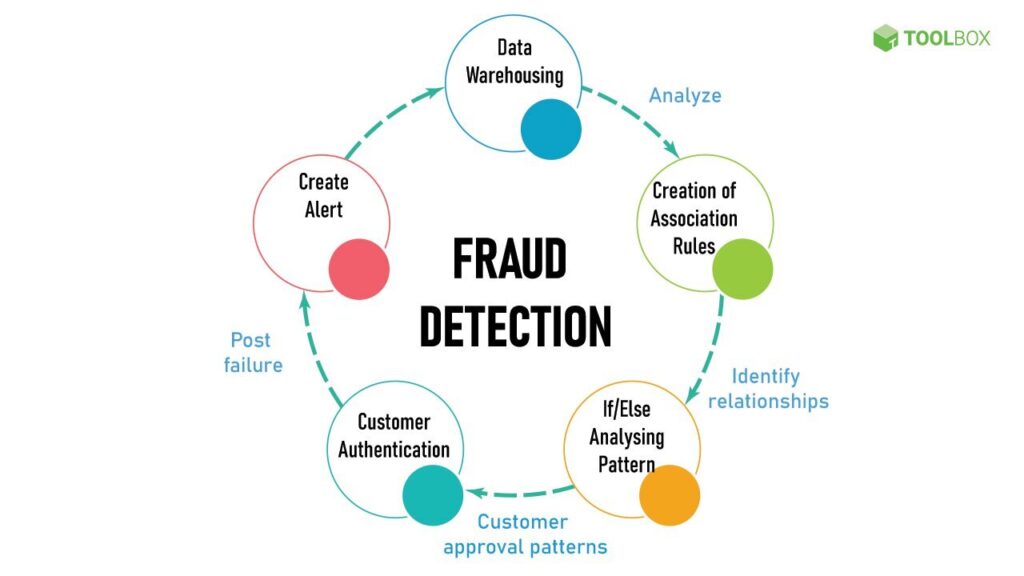

AI-driven fraud detection systems utilize machine learning algorithms to analyze vast amounts of data, identifying patterns and anomalies that may indicate fraudulent behavior. These systems operate through several key processes:

-

Data Collection: Aggregating extensive transactional and behavioral data from various sources to establish a comprehensive dataset for analysis.

-

Feature Engineering: Selecting relevant attributes that could signal fraudulent activities, such as transaction amounts, frequency, and geographic locations.

-

Model Training: Training machine learning models using historical data to recognize patterns associated with fraud, thereby improving their predictive capabilities over time.

-

Anomaly Detection: Continuously monitoring transactions to identify deviations from established norms, allowing for the quick flagging of suspicious activities.

-

Continuous Learning: Updating the models with new data to adapt to evolving fraudulent tactics, ensuring that the system remains effective against new threats[1][2][4].

Real-Time Monitoring and Its Importance

The ability to monitor transactions in real-time is a significant advantage of AI in fraud detection. Traditional methods often rely on static rules that can quickly become obsolete as fraud tactics evolve. In contrast, AI systems can dynamically adjust their detection algorithms based on real-time data inputs, allowing for immediate responses to potential threats. This capability is crucial for industries such as banking and e-commerce, where timely intervention can prevent substantial financial losses and protect customer trust[2][5].

Applications Across Industries

AI fraud detection is being employed across various sectors, each leveraging its capabilities to combat fraud effectively:

-

Banking: Financial institutions utilize AI to monitor account activities and transactions, detecting anomalies like unusual withdrawals or transactions from unfamiliar locations. This proactive approach helps in preventing identity theft and account takeovers[3][5].

-

E-commerce: Online retailers implement AI systems to analyze transaction patterns, flagging potential fraud based on inconsistencies in billing and shipping information. This not only enhances security but also reduces chargeback costs associated with fraudulent transactions[2][4].

-

Gaming: Online gaming platforms employ AI to monitor in-game transactions, identifying patterns that may indicate fraud, such as the use of stolen credit cards or manipulation of game assets. This ensures a fair gaming environment and protects revenue streams[2][3].

Conclusion

The integration of AI in fraud detection represents a significant advancement in the fight against financial crime. By leveraging real-time monitoring and machine learning capabilities, businesses can enhance their defenses against fraud, safeguarding their operations and maintaining customer trust. As fraud tactics continue to evolve, the importance of AI-driven solutions will only increase, making them an essential component of modern cybersecurity strategies[1][2][4][5].

Further Reading

1. datadome.co

2. Understanding AI Fraud Detection and Prevention Strategies | DigitalOcean

3. How AI And Machine Learning Help Detect And Prevent Fraud

4. Fraud Detection Using Machine Learning & AI in 2024 | SEON

5. How Fraud Detection Using AI in Banking Works? | Infosys BPM