The integrated cabin and parking market has seen a significant surge.

Since last year, industry giants like Bosch, Aptiv, Huayang, and ECARX Technology have launched integrated cabin and parking solutions, with some already designated or mass-produced by OEMs. For instance, ECARX Technology’s upgraded ECARX Antola 1000 computing platform, featuring the 7nm automotive-grade SoC “Dragon Eagle One,” is now installed in Geely’s Galaxy E5 model.

Rising Demand for Integration

Industry insiders reveal that the demand for cabin and parking integration is increasing as OEMs strive to reduce costs and improve efficiency through cross-domain integration. This trend is driven by the widespread adoption of high-computing intelligent cockpit chips like Qualcomm 8155 and 8295, providing the necessary computational power for such integration.

According to the Gaogong Intelligent Vehicle Research Institute, 12.12 million passenger cars equipped with intelligent digital cockpits were delivered in the Chinese market in 2023, with a pre-installation rate of 57.40%. Among these, 3.49 million units featured cockpit domain controllers, marking a 111.43% year-on-year increase.

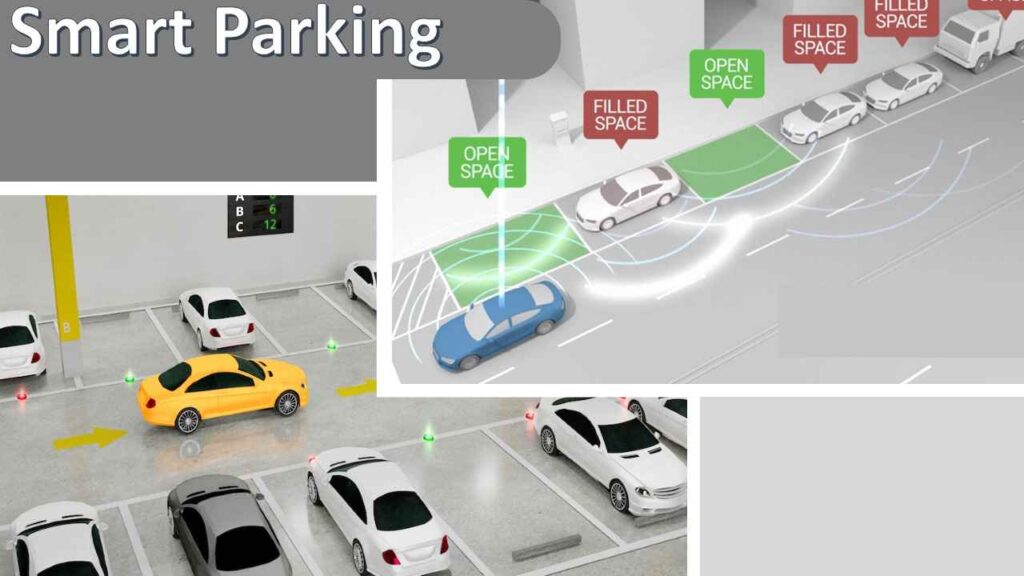

This integration allows OEMs to connect parking sensors to existing intelligent cockpit controllers, integrating parking algorithms to combine cockpit, 360-degree panoramic view, and parking functions, significantly reducing costs. It is estimated that this integration can save hundreds or even nearly a thousand yuan per vehicle.

The Gaogong Intelligent Vehicle Research Institute reports that 2023 saw close to 3.5 million passenger cars in China equipped with automatic parking (APA) and in-cabin entertainment systems, with an annual growth rate of 20-30%. This highlights the substantial potential for the cabin and parking integration market, exceeding 3.5 million vehicles annually.

Key to Popularizing Intelligent Vehicles: Cost Reduction

The automotive intelligence competition is intensifying, with major OEMs focusing on reducing costs and improving development efficiency. Integration systems, such as cabin and parking integration, play a crucial role in achieving these goals by enhancing user experience and reducing vehicle costs.

Wu Shicai, partner & CTO of Fuyihang Intelligent Technology, notes that many new cars feature high-computing heterogeneous chips like Qualcomm 8155/8255/8295, providing ample computing power for integrating parking functions with cockpit controllers, thereby saving on additional computing chips and peripheral devices.

For instance, Bosch’s integrated solution using Qualcomm 8255 or 8295 chips connects vehicle sensors directly to the cockpit domain controller, integrating parking algorithms and functional safety software, simplifying the vehicle’s electronic architecture and reducing hardware costs.

The integration of cabin and parking not only reduces hardware costs but also optimizes parking functions by leveraging the cockpit SoC’s capabilities, such as GPU for 3D rendering and environmental puzzles, enhancing the human-machine interaction in parking scenarios.

Market Expansion and Future Trends

While the market for integrated driving and parking is booming, the integrated cabin and parking market is comparatively smaller due to separate development teams and differing development models for cockpit and parking functions within OEMs and Tier 1 suppliers. However, this is changing as OEMs seek suppliers offering integrated solutions to quickly reduce intelligent vehicle costs.

Leading Tier 1 companies like Bosch, ECARX, and Desay SV are securing projects and are expected to achieve mass production of integrated cabin and parking solutions by 2024-2025. These solutions include domestic chips like “Dragon Eagle No. 1” and SemiDrive Technology’s X9U and X9SP processors.

In the 1.0 era of cabin and parking integration, basic parking functions are realized by integrating surround view cameras and ultrasonic radars. The upcoming 2.0 era will incorporate AI models and additional in-cabin sensors, enabling more advanced intelligent driving functions.

The ultimate goal is the integration of cabin, parking, and driving functions. However, the integration of basic parking functions into the cockpit domain is more suitable for low-end models, while high-end parking functions requiring higher safety levels are better suited for integrated driving and parking solutions.

As integrated cabin and parking solutions become more widespread, they are expected to resolve cost-effective challenges and drive rapid growth in market penetration, making parking functions a standard feature in intelligent vehicles.

4o