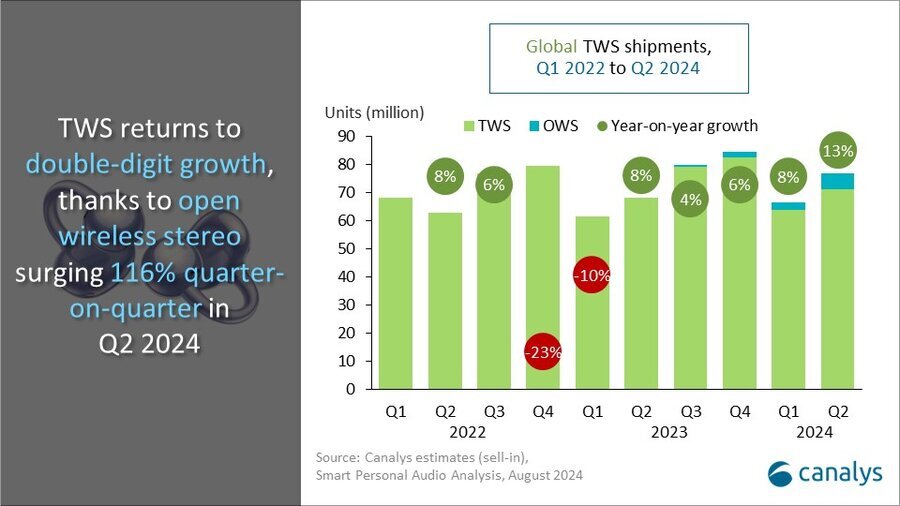

In the second quarter of 2024, the smart personal audio market made a significant recovery, bolstered by impressive gains across various segments. According to the latest research from Canalys, shipments soared to 106 million units, an increase of 10.6% compared to the same period last year, marking the highest number of second-quarter shipments to date. Particularly, TWS (True Wireless Stereo) and wireless headphones acted as primary growth engines, with shipments reaching 77 million and 15 million units, respectively.

TWS Continues to Lead and Innovate

The TWS segment retained its dominance in the global smart personal audio market, capturing a commanding 72.6% market share while also experiencing a notable 12.6% growth year-over-year. Despite a general slowdown in the traditional TWS market, leading vendors have strategically navigated challenges by pricing models below $50. For the first time, this sub-$50 segment comprised more than half of the market for the quarter.

“Manufacturers are actively seeking to incorporate novel features to distinguish themselves amid intensified competition characterized by homogeneous features and price wars,” said Cynthia Chen, Research Manager at Canalys. “Huawei’s Lipstick 2, for instance, appeals to female consumers with its premium materials and stylish design. JBL has integrated a display into earphone cases to allow users to check notifications directly, reducing phone dependence. Meanwhile, companies like Nothing and iFlytek are infusing AI assistant features into their latest models, though it’s still early to measure the impact of these innovations on user experience and engagement.”

The Rise of Open-Form Factor

Open-form factor designs have emerged as a significant growth driver this quarter for both TWS and wireless earphones. “High technical barriers have historically constrained this form factor. However, vendors are succeeding in bringing these designs to a broader market by offering unique user experiences at affordable prices,” added Chen. Leading brands such as Shokz, with their focus on sports integration, and Huawei, with innovative clip-on designs, collectively hold over 10% of the market share in this segment. As more vendors enter the fray, the novelty factor will wane, necessitating a focus on product quality and feature enhancements.

Wireless Headphones Market Rebounds With Diverse Offerings

“The market expansion by emerging players has revived the wireless headphones segment in Q2,” noted Jack Leathem, Research Analyst at Canalys. Brands like QCY, Baseus, and Anker are making significant inroads in the international market with products priced between $50 and $100. These brands are disrupting the entry-level segment with seamless wireless connectivity and extended battery life, quickly establishing themselves in retail channels. Conversely, established brands like Bose and Sony dominate the high-end market (above $350), having withdrawn from low-end competition to concentrate on premium sound quality and advanced audio fidelity. This allows them to safeguard their high-end user base and build sustainable revenue streams.

“The audio market is becoming increasingly crowded as major vendors still see opportunities for expansion,” added Chen. “Technological advancements enable branded vendors to offer high-quality, high-performance products at competitive prices, displacing white-label products, especially in emerging regions. Additionally, improved connectivity and changing consumer preferences have accelerated the shift from wired to wireless headphones, laying a strong foundation for growth in the wireless audio sector. In this dynamic segment, vendors must align their differentiation strategies with their core business strategies to resonate with target consumers and effectively communicate their brand’s unique value proposition.”

For more details and inquiries:

- Cynthia Chen: cynthia_chen@canalys.com

- Jack Leathem: jack_leathem@canalys.com

About Smart Personal Audio Analysis:

Canalys’ Smart Personal Audio Analysis service provides qualitative and quantitative insights into the market for smart personal audio devices. It helps vendors and partners make informed decisions on value propositions, select the right channel partners, and sell on appropriate platforms globally.

About Canalys:

Canalys is an independent analyst firm dedicated to guiding clients on the future of the technology industry, encouraging them to think beyond traditional business models. We offer smart market insights to IT, channel, and service provider professionals worldwide and stake our reputation on the quality of our data, innovative technology use, and superior customer service.

Stay Updated:

For media alerts, information about our events, services, or bespoke research and consulting capabilities, contact us or email press@canalys.com.